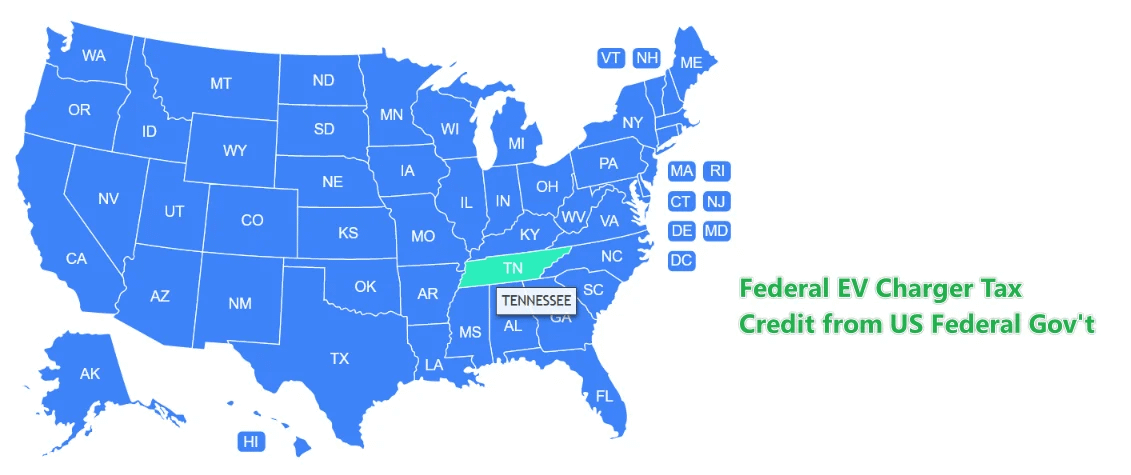

The Federal EV Charger Tax Credit allows a credit for qualified alternative fuel vehicle refueling property placed in service during the tax year. For business/investment use property, the credit is the smaller of 6% (or 30% if prevailing wage/apprenticeship requirements are met) of the property’s cost or $100,000 per item. For personal use property installed at your main home, the credit is generally the smaller of 30% of the cost or $1,000 per item.

To qualify, the refueling property must:

Eligible census tracts are generally low-income community tracts or non-urban areas, determined using IRS mapping tools.

For property placed in service after 2022, prevailing wage and registered apprenticeship requirements must be met to claim the higher 30% credit rate for business property. Detailed recordkeeping of wages/hours is required.

The credit is first applied against alternative minimum tax, with any excess claimed as a general business credit or nonrefundable personal credit. Tax-exempt entities can elect to treat the credit as a payment against income tax liability after 2022. Starting in 2023, credits can be transferred to third parties for cash.

The Alternative Fuel Vehicle Refueling Property Credit under IRC Section 30C incentivizes businesses and individuals to install qualified alternative fuel vehicle refueling or charging property.

For business/investment use property placed in service:

For personal use property installed at main home:

Qualified property includes:

Location Requirements (after 2022):

Recordkeeping for Prevailing Wage/Apprenticeship:

Other Key Points: